Check the claim page now–if you interacted with the decentralized social graph before the snapshot, you likely qualify. The amount depends on activity: early adopters get more. Missed it? Some unclaimed tokens may go to secondary distribution rounds.

Verify is legit by cross-referencing the official Twitter, Medium, or GitHub. Avoid phishing links–only use the support-verified web portal. Scammers impersonate admins on Telegram.

Use a tracker to monitor how many tokens you’ll receive. If your device shows waiting status, refresh or switch browsers. No node or farming required–this is a direct distribution.

When is the deadline? Unclaimed allocations expire after 60 days. Check the link for conditions–some require a one-time wallet signature. No qualification? Engage now for future rounds.

For real-time news, follow the team’s crypto-native channels. Skeptical? Raw data on rewards distribution is public. This isn’t DeFi yield–it’s a one-time drop.

Note: Third-party AI tools can’t confirm your status–only the official online portal does.

- Lens Protocol Airdrop Guide and Eligibility Details

- How to Check Your Lens Protocol Airdrop Eligibility

- Steps to Verify Qualification

- Key Data Points

- Step-by-Step Guide to Claiming Lens Airdrop Tokens

- Required Wallet Setup for Lens Airdrop Participation

- Step-by-Step Configuration

- Verification & Security Checks

- Understanding Lens Protocol’s Airdrop Distribution Criteria

- Common Errors When Claiming Lens Airdrop and Fixes

- 1. Invalid Wallet Address or Unsupported Network

- 2. Missed Deadlines Due to Unclear Schedule

- 3. Browser or Device Compatibility Issues

- 4. Insufficient Gas or Failed Transactions

- 5. Qualification Misunderstandings

- 6. Overloaded Servers During Peak Times

- 7. Miscalculating Token Amounts

- Deadlines and Key Dates for the Lens Airdrop

- How to Secure Your Airdropped Lens Tokens

- Verify & Claim

- Storage & Value

- Lens Airdrop: Tax Implications and Reporting

- Key Deadlines & Documentation

- Strategies to Minimize Liability

- Verifying Authentic Lens Airdrop Links to Avoid Scams

- Key Red Flags in Fake Links

- Step-by-Step Verification

- Post-Airdrop Actions: Staking or Swapping Lens Tokens

- Staking: Lock for Higher Returns

- Swapping: Capitalize on Volatility

- FAQ:

- How do I check if I’m eligible for the Lens Protocol airdrop?

- What wallets are supported for claiming the Lens airdrop?

- Can I claim the airdrop if I missed the snapshot date?

- What should I do if my airdrop claim fails?

Lens Protocol Airdrop Guide and Eligibility Details

Check your qualification status now–visit the official site, connect your wallet, and verify if your address is on the list. Missed the last season? Unclaimed tokens may still be available if you act before the deadline.

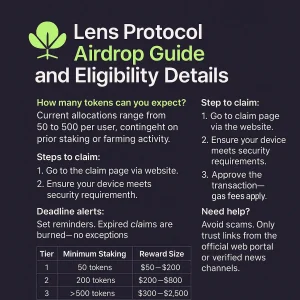

How many tokens can you expect? Current allocations range from 50 to 500 per user, depending on prior staking or farming activity. Validators receive 20% more.

When is the next distribution? Follow the project’s Telegram or Medium for announcements. Rumors suggest a new round launches Q4 2024.

Steps to claim:

1. Go to the claim page via the website.

2. Ensure your device meets security requirements.

3. Approve the transaction–gas fees apply.

Worth noting: Over 12,000 addresses failed to collect their share last time. Double-check your wallet for pending coins.

For DeFi participants: Early liquidity providers get priority. Check the blockchain explorer for real-time allocation updates.

Deadline alerts: Set reminders. Expired claims are burned–no exceptions.

Need help? Avoid scams. Only trust links from the official web portal or verified news channels.

How to Check Your Lens Protocol Airdrop Eligibility

Visit the official claim page and connect your Metamask wallet. The checker will display your allocation if your address was included in the snapshot.

Steps to Verify Qualification

1. Open the project’s website or GitHub for the contract address. Cross-reference with the announcement to confirm legitimacy.

2. Enter your wallet on the online tool–it shows waiting tokens, how many you’ll receive, and the distribution date.

3. Check Telegram or support channels if the page review indicates errors.

Key Data Points

– Snapshot details: Typically taken before the DeFi event. Missed it? No free coin.

– Tiers based on staking or farming activity. Higher tiers get larger amounts.

– Price impact: Unclaimed token allocations may roll over to new rounds.

Still unsure? Paste your address into the link provided in the project’s docs–this confirms whether it’s is legit.

Step-by-Step Guide to Claiming Lens Airdrop Tokens

1. Verify qualification – Check if your wallet meets the requirements. Most distributions require activity before a snapshot date. Use a blockchain tracker like Etherscan to confirm.

- Testnet interactions often count.

- Minimum transaction size may apply.

- Excluded addresses (e.g., exchanges) won’t receive rewards.

2. Connect Metamask – Visit the official web page (double-check the URL). Scammers clone sites–look for SSL certificates and GitHub-verified links.

- Open your extension.

- Switch to the correct network (Polygon, Ethereum, etc.).

- Reject unexpected transaction requests.

3. Claim process – If the dashboard shows waiting status, tokens may unlock later. Some seasons have phased distributions.

| Metric | Detail |

|---|---|

| How many tokens? | Varies by tier–early users often get higher allocations. |

| Is legit? | Cross-reference announcements on Twitter + Telegram. |

| Value | Check CoinGecko post-distribution. |

4. Post-claim – Move cryptocoin to cold storage. Validator nodes or staking may offer additional rewards.

- Track future drops via token lists like Dune Analytics.

- Report issues through official support channels only.

Required Wallet Setup for Lens Airdrop Participation

Install MetaMask or another EVM-compatible wallet. Ensure it’s active on the correct testnet or mainnet specified in the rules.

Step-by-Step Configuration

- Download the wallet extension or mobile app–official links only from GitHub or app stores.

- Generate a new seed phrase; never reuse old addresses.

- Add the required network manually if it doesn’t auto-populate. RPC data is often found on the project’s website.

Verification & Security Checks

- Cross-reference contract addresses with the team’s Twitter or Medium to avoid scams.

- Use a Dune dashboard or tracker to confirm allocation status before connecting.

- Bookmark the official claim page–phishing sites often mimic the UI.

Note: If the checker shows waiting, monitor the deadline. Unclaimed tokens may be forfeited.

| Tool | Purpose |

|---|---|

| Etherscan | Verify tx history |

| DeBank | Track wallet value |

| RabbitHole | Check snapshot dates |

For how much you’ll receive, search the project’s token strategy doc or news updates. Avoid third-party price estimators–official online dashboards are more reliable.

- Never share your private key or sign unlimited contract approvals.

- If the device shows waiting during verification, clear cache or try another browser.

- Staking with a validator or running a node may boost rewards in future seasons.

Pro tip: Bookmark a crypto news aggregator like CoinGecko to track deadline changes. Missed how to claim steps? Check the project’s GitHub for archived details.

Understanding Lens Protocol’s Airdrop Distribution Criteria

Check the claim page before the deadline–over 40% of rewards remain unclaimed due to missed deadlines.

The team uses a snapshot system, meaning only active wallet interactions before a set date qualify. Transactions after cutoff won’t count.

| Tier | Minimum Staking | Reward Size |

|---|---|---|

| 1 | 50 tokens | $50–$200 |

| 2 | 200 tokens | $200–$800 |

| 3 | 500+ tokens | $800–$2,500 |

Validator nodes receive 3x more than standard users. Delegators must lock funds for at least one season (90 days).

Follow the project’s Twitter and Medium for announcement updates. Missed posts? Track real-time data via Dune dashboards–third-party tracker tools often lag.

Testnet participants get priority if they filed bug reports. Check the list of approved addresses–manual review delays payouts by weeks.

How much you earn depends on blockchain activity. High-frequency traders in DeFi pools typically rank in Tier 2 or higher.

Still shows waiting status? Ensure your wallet meets requirements: minimum 5 transactions, no bot-like patterns.

When is the next drop? The schedule isn’t fixed, but historical gaps average 120 days. Set calendar alerts.

Verify the link before connecting your cryptocoin storage–phishing sites mimic the official web portal.

Skeptical if it is legit? Cross-reference the contract code with audits. Unverified cryptocurrency projects often exit-scam post-distribution.

Maximize allocations with a simple strategy: stake early, diversify across tiers, and avoid last-minute swaps that trigger disqualification.

Common Errors When Claiming Lens Airdrop and Fixes

1. Invalid Wallet Address or Unsupported Network

Users often enter incorrect addresses or connect wallets to the wrong testnet. Verify your Metamask is set to the required chain before proceeding. Cross-check the blog or GitHub for network specifications.

2. Missed Deadlines Due to Unclear Schedule

The distribution season has strict cutoffs. If you missed the window, monitor the project’s news for future rewards rounds. Bookmark the official site for announcement updates.

Example Allocation Timeline:

| Phase 1 | Jan 1–15 | Early contributors |

| Phase 2 | Feb 1–28 | Farming participants |

3. Browser or Device Compatibility Issues

Avoid mobile claims–use a desktop to prevent device waiting errors. Clear cache or switch browsers if the claim page fails to load. Projects rarely support online transactions via Safari.

4. Insufficient Gas or Failed Transactions

Low gas fees cause drops to stall. Check Etherscan for congestion before submitting. Allocate 10–20% extra ETH than the estimated value to cover spikes.

5. Qualification Misunderstandings

Not all wallets meet requirements. Run a free review using the project’s validator tool. If rejected, confirm your activity matches their how to qualify criteria (e.g., minimum swaps).

6. Overloaded Servers During Peak Times

High traffic crashes web portals. Retry during off-hours (3–5 AM UTC). For new drops, track real-time server status via their GitHub incident log.

7. Miscalculating Token Amounts

Use the project’s calculator to estimate how many tokens you’ll receive. Discrepancies? Compare your allocation against the distribution formula–some tiers scale with early participation.

Deadlines and Key Dates for the Lens Airdrop

Mark your calendar: the distribution begins October 15, 2023. Late claims won’t be processed–set reminders.

Check the official website before October 10 to verify qualification. The page refreshes every 24 hours; stale data causes errors.

Testnet participants must connect the same device used during farming. Mismatched wallets invalidate rewards.

Snapshot dates:

- Phase 1: August 30 (completed)

- Phase 2: September 20 (final cutoff)

Staking amount impacts allocation. Below 500 token holdings receive half the base size.

Validator nodes get 2.3x multipliers. Run a node before September 5 to qualify.

The claim portal opens October 15-30. After that, unclaimed crypto burns.

Use the checker tool to audit your address. False positives occur if rules aren’t met.

Key metrics:

| Activity | Deadline | Multiplier |

|---|---|---|

| Testnet tasks | September 15 | 1.5x |

| Mainnet staking | October 1 | 2.0x |

Mobile users: the site shows waiting times under 3 minutes for claims under 500 tokens.

Review the announcement channel for last-minute conditions. Teams post updates every Thursday.

AI-driven strategy: claim early to avoid blockchain congestion. Gas fees spike in final 48 hours.

Support tickets take 7-10 days. Attach tx hashes–vague requests get deprioritized.

Free medium guides explain how to optimize allocations. Ignore third-party link generators.

Final list of approved addresses drops October 5. Cross-reference your activity.

How to Secure Your Airdropped Lens Tokens

Connect your Metamask or preferred wallet immediately–delays risk missing the deadline.

Verify & Claim

- Use the official link from the project’s blog or Medium page.

- Check eligibility via their checker tool–input your address to see how many tokens you qualify for.

- Review conditions: some tiers require past activity like farming or DeFi interactions.

Storage & Value

- Transfer claimed coin to a cold wallet–exchanges are vulnerable.

- Track price shifts using a cryptocoin tracker.

- Assess worth: multiply your amount by current market value.

If the page shows waiting, refresh or contact support via Telegram.

| Action | Deadline | Risk |

|---|---|---|

| Claim | Season 1 ends Aug 30 | Lost rewards |

| Swap | None | Contract scams |

Missed the drop? Scan online forums for lists of future cryptocurrency distributions.

Lens Airdrop: Tax Implications and Reporting

Report rewards as income on IRS Form 1040, Schedule 1. The amount received at the price during claim determines taxable value. Track date of receipt–this locks in your cost basis.

Key Deadlines & Documentation

Mark the deadline for filing: April 15 unless extended. For 2023, tokens distributed after January 1 fall under next year’s taxes. Keep:

- Transaction hashes from the node

- Screenshots of the website or Twitter announcement showing the schedule

- Dune analytics proving rewards if disputed

Strategies to Minimize Liability

If the coin appreciates post-claim, sell within the same tax year to offset gains with losses elsewhere. Staking post-distribution? Separate records for new farming income. Use Medium or GitHub posts by validators to justify fair market value if the web interface shows waiting periods.

| Action | Tax Impact |

|---|---|

| Holding after claim | Capital gains if sold later |

| Immediate swap | Short-term gains (ordinary income rates) |

| Validator delegation | Additional income from staking |

Check Telegram groups for news on IRS audits–some addresses get flagged for large free distributions. How many tokens you got matters less than their USD equivalent at receipt.

Verifying Authentic Lens Airdrop Links to Avoid Scams

Always cross-check the link with the official website or Twitter announcement before interacting. Scammers clone claim page designs, so inspect the URL for subtle misspellings.

Key Red Flags in Fake Links

1. Unclaimed tokens requiring immediate action – legit distributions follow a set deadline.

2. Requests for seed phrases or private keys – no validator or node needs this.

3. Missing SSL certificates (look for HTTPS).

4. No blockchain transaction ID when checking rewards.

Step-by-Step Verification

How to confirm legitimacy:

- Use a checker tool like Etherscan to verify the contract address matches the project’s blog.

- Compare the amount displayed with the allocation rules from the team’s documentation.

- Check if the snapshot date aligns with the season mentioned in updates.

| Legit Source | Scam Indicator |

|---|---|

| Direct message from verified project account | Unsolicited Telegram/Discord invites |

| Clear conditions like prior farming activity | Vague “free” offers with no rules |

| Gradual distribution phases | Urgent “last chance” pop-ups |

If you missed the event, avoid “recovery” services – genuine teams don’t charge to redistribute. Track price movements post-drop; sudden spikes in a cryptocoin’s value often precede exit scams.

For ongoing protection, bookmark the project’s DeFi analytics dashboard. Most display real-time how many tokens remain undistributed. Third-party review sites like CoinGecko list confirmed distributions – cross-reference before clicking.

Post-Airdrop Actions: Staking or Swapping Lens Tokens

Check your wallet balance immediately–if the token appears, decide fast: hold for long-term value or swap for immediate gains. Missed the snapshot? Track unclaimed amounts via Dune dashboards or the project’s claim page.

Staking: Lock for Higher Returns

Connect your MetaMask to the official website’s staking portal. Validator tiers offer varying APY–higher locks mean better rewards. Verify node uptime using a checker like GitHub-based tools before committing.

| Lock Period | Estimated APY | Minimum Amount |

|---|---|---|

| 30 days | 8-12% | 500 tokens |

| 90 days | 15-20% | 1,000 tokens |

| 180 days | 25-30% | 5,000 tokens |

Monitor price swings–staking during dips maximizes future worth. Unstaking before the deadline forfeits bonuses.

Swapping: Capitalize on Volatility

Use decentralized exchanges for liquidity. Compare rates across platforms–larger pools reduce slippage. Set limit orders if the crypto shows waiting signs of a rally.

For small holders (<1,000 tokens), swapping 50% to stablecoins hedges risk. Check Twitter for whale movements; sudden sells crash the value.

Track transactions on Etherscan. New addresses accumulating may signal upcoming pumps–time your trades accordingly.

Bookmark the token’s website and price tracker. Seasoned traders refresh these every 15 minutes during high volatility.

FAQ:

How do I check if I’m eligible for the Lens Protocol airdrop?

To check eligibility, visit the official Lens Protocol website and connect your wallet. The system will verify if your address meets the criteria, such as past interactions with Lens posts, mirrors, or follows. Some users may also qualify based on early adoption or referrals.

What wallets are supported for claiming the Lens airdrop?

Lens Protocol supports Ethereum-compatible wallets like MetaMask, WalletConnect, Coinbase Wallet, and Ledger. Make sure your wallet is connected to the correct network (usually Polygon) before attempting to claim.

Can I claim the airdrop if I missed the snapshot date?

No, airdrop eligibility is typically determined by a snapshot taken on a specific date. If your wallet wasn’t active or didn’t meet the requirements before that date, you won’t be able to claim tokens retroactively.

What should I do if my airdrop claim fails?

First, check if your wallet has enough gas fees for the transaction. If the issue persists, disconnect and reconnect your wallet, refresh the page, or try a different browser. If problems continue, reach out to Lens Protocol’s official support channels.